Navigating the New York State Pension Calendar: A Complete Information for Retirees and Future Retirees

Associated Articles: Navigating the New York State Pension Calendar: A Complete Information for Retirees and Future Retirees

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Navigating the New York State Pension Calendar: A Complete Information for Retirees and Future Retirees. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Navigating the New York State Pension Calendar: A Complete Information for Retirees and Future Retirees

The New York State retirement system is a fancy community of plans designed to supply monetary safety to public workers after years of devoted service. Understanding the intricacies of this method, notably the related calendar and deadlines, is essential for each present workers planning for retirement and people already receiving advantages. This text serves as a complete information to the New York State pension calendar, masking key dates, vital issues, and sources that can assist you navigate this vital facet of your monetary future.

Understanding the Completely different Retirement Techniques:

Earlier than diving into the calendar specifics, it is vital to know that New York State would not have a single pension system. The panorama is numerous, encompassing a number of main plans, every with its personal guidelines, advantages, and timelines:

-

New York State and Native Staff’ Retirement System (ERS): That is the most important system, masking a overwhelming majority of state and native authorities workers. It is additional divided into a number of tiers, every with totally different contribution charges and profit formulation. Understanding which tier you fall below is essential for correct retirement planning.

-

New York State Police and Fireplace Retirement System (PFRS): This method caters particularly to cops and firefighters, providing distinctive advantages and contribution constructions tailor-made to the inherent dangers of their professions.

-

New York Metropolis Retirement Techniques: New York Metropolis operates its personal separate retirement techniques, impartial of the state techniques. These techniques have their very own particular calendars and laws.

-

Academics’ Retirement System (TRS): This method covers academics and different instructional professionals employed inside the state. Like the opposite techniques, it has its personal distinctive guidelines and profit calculations.

This text primarily focuses on the overall calendar features related to most New York State pension techniques, highlighting key dates that apply throughout a number of plans. Nevertheless, it is essential to seek the advice of your particular plan’s documentation for exact particulars relating to your particular person circumstances.

Key Dates and Deadlines on the New York State Pension Calendar:

The New York State pension calendar will not be a single, monolithic doc. As an alternative, it is a assortment of essential dates and deadlines scattered throughout numerous publications and on-line sources. These dates usually revolve round:

-

Utility Deadlines: Retiring workers should submit their retirement functions by particular deadlines to make sure well timed processing of their advantages. These deadlines fluctuate relying on the retirement system and the kind of retirement being pursued (e.g., early retirement, common retirement, incapacity retirement). Lacking these deadlines can considerably delay the graduation of advantages.

-

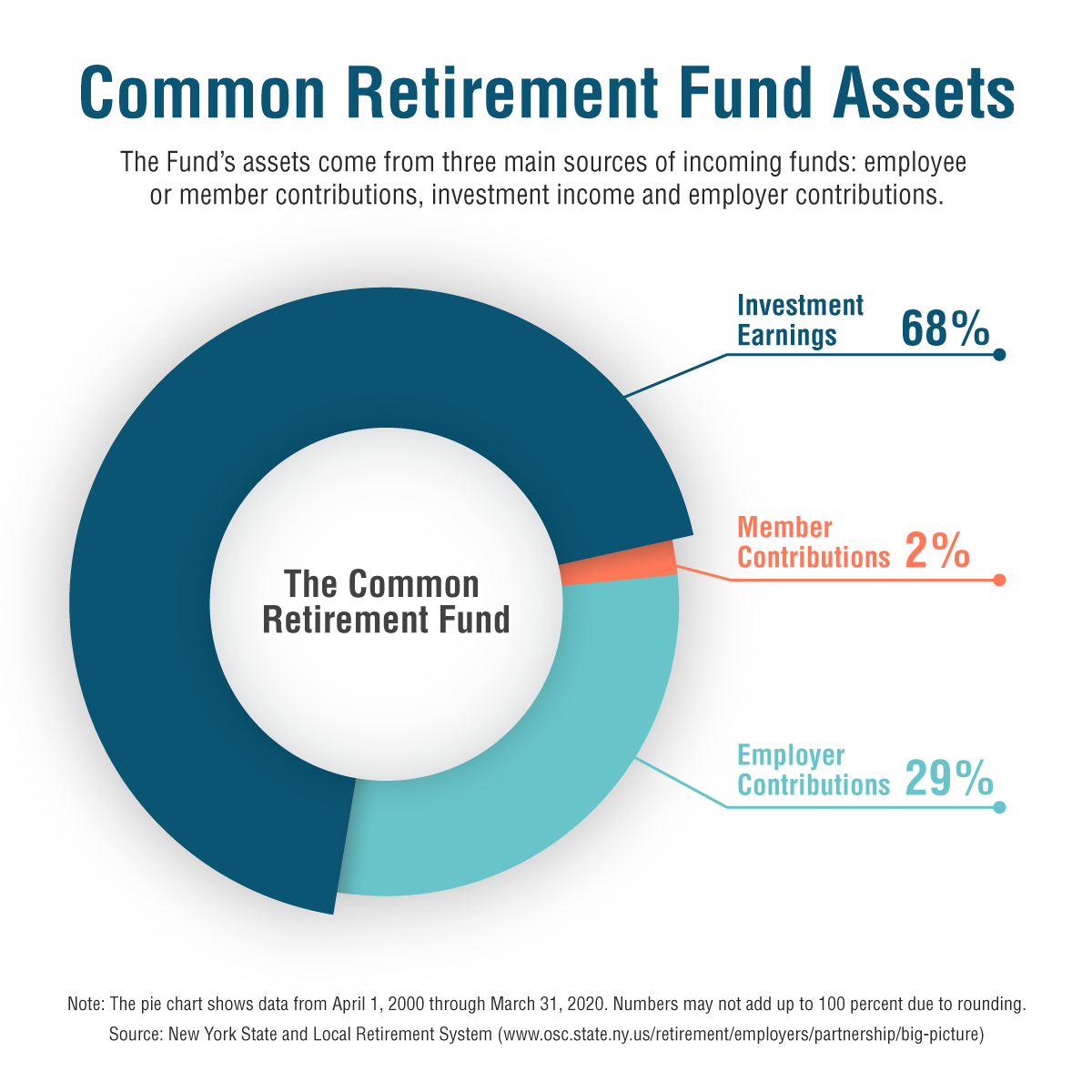

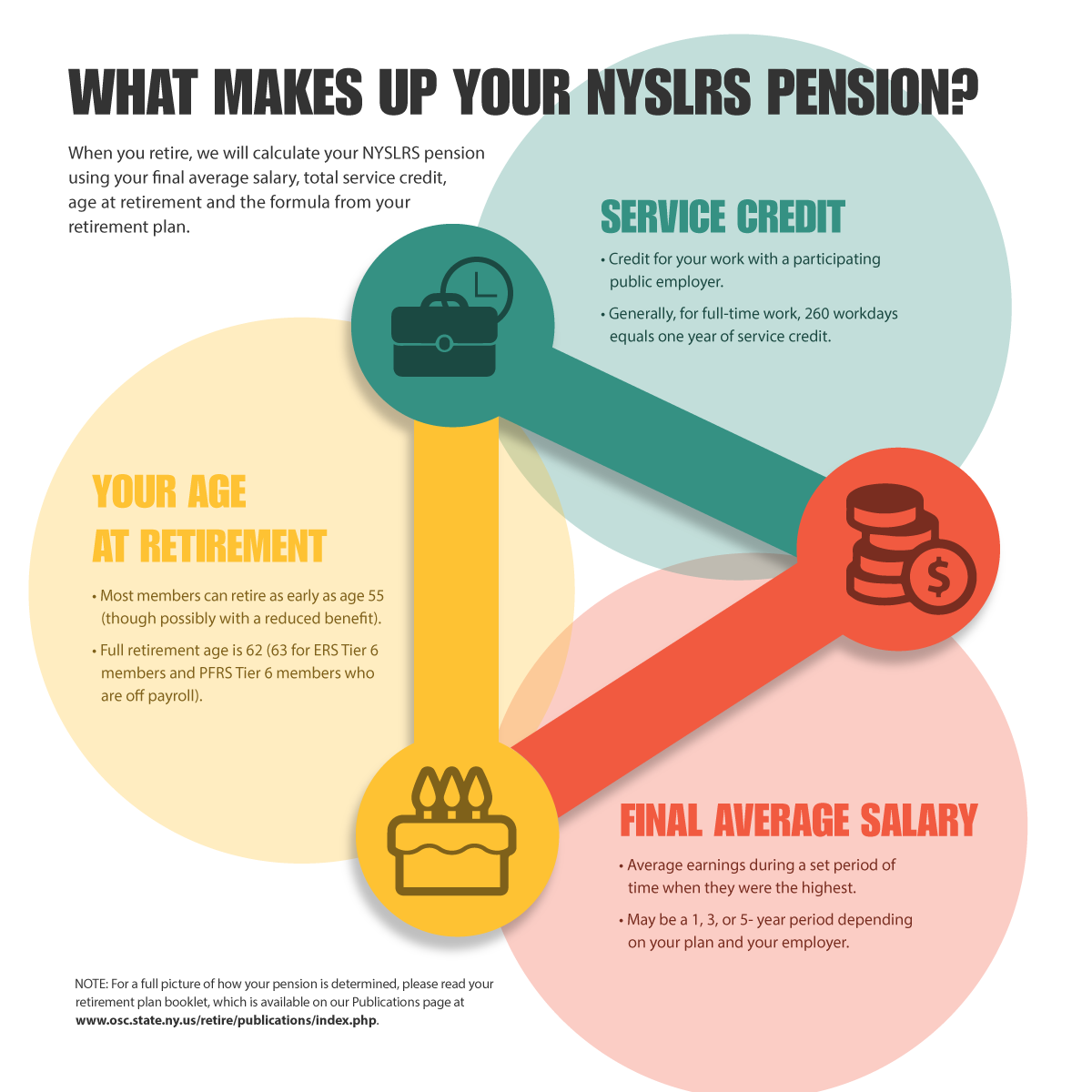

Profit Calculation Dates: The calculation of your retirement advantages entails a fancy components that considers components like years of service, wage historical past, and the precise plan’s profit construction. Understanding the timeframe for these calculations is essential for correct monetary planning.

-

Fee Dates: Pension funds are usually issued on a daily schedule, typically month-to-month. Realizing the cost dates permits for higher budgeting and monetary administration. These dates are normally constant however will be affected by holidays and different unexpected circumstances.

-

Annual Reporting Deadlines: Retirees could also be required to submit annual stories to keep up their eligibility for advantages. Failure to adjust to these reporting necessities can result in suspension or termination of advantages.

-

Contribution Deadlines: For lively workers, understanding the deadlines for making contributions to their pension plan is important to keep away from penalties and make sure the correct calculation of future advantages.

The place to Discover the Related Info:

Navigating the varied deadlines and dates will be difficult. Listed below are the first sources for locating essentially the most up-to-date data:

-

Your Employer’s Human Sources Division: That is your first level of contact for questions relating to your particular pension plan and its related calendar. They will present personalised steerage primarily based in your employment historical past and retirement plans.

-

The New York State Comptroller’s Workplace: This workplace oversees most of the state’s retirement techniques and gives beneficial sources, together with publications, FAQs, and call data for particular plans. Their web site is a vital useful resource for understanding the general framework of the pension system.

-

Particular person Retirement System Web sites: Every retirement system (ERS, PFRS, TRS, and many others.) usually has its personal web site with detailed details about its particular laws, profit calculations, and calendar of vital dates.

-

Retirement Counselors and Monetary Advisors: Consulting with knowledgeable specializing in retirement planning can present invaluable help in navigating the complexities of the New York State pension system and guaranteeing you make knowledgeable selections about your monetary future.

Planning for Retirement: Utilizing the Calendar Successfully:

The New York State pension calendar will not be merely a listing of dates; it is a roadmap for securing your monetary future. Efficient use of this calendar requires proactive planning:

-

Begin Early: Start planning for retirement effectively upfront of your meant retirement date. This enables ample time to know your advantages, deal with any uncertainties, and make vital changes to your monetary technique.

-

Keep Organized: Preserve meticulous data of your contributions, employment historical past, and any communication with the related retirement system. This documentation might be invaluable when making use of for advantages and resolving any potential discrepancies.

-

Search Skilled Recommendation: Do not hesitate to hunt skilled steerage from monetary advisors or retirement counselors. They might help you perceive the complexities of the system and develop a personalised retirement plan that aligns together with your targets and circumstances.

-

Monitor Modifications: Pension laws and profit constructions can change over time. Keep knowledgeable about any updates or modifications to your plan by usually checking the related web sites and publications.

Conclusion:

The New York State pension calendar is a crucial ingredient within the retirement planning course of for public workers. By understanding the varied techniques, key dates, and out there sources, you possibly can navigate the complexities of the system and safe a cushty retirement. Do not forget that proactive planning, diligent record-keeping, and looking for skilled recommendation are essential steps in maximizing your retirement advantages and guaranteeing a financially safe future. This text serves as a place to begin; all the time seek the advice of official sources and search personalised steerage to make sure correct and up-to-date data related to your particular circumstances.

Closure

Thus, we hope this text has supplied beneficial insights into Navigating the New York State Pension Calendar: A Complete Information for Retirees and Future Retirees. We admire your consideration to our article. See you in our subsequent article!